In 2022, generic drugs accounted for 90% of all prescriptions in the U.S. but only 23% of total prescription drug spending. That's a huge difference-yet for many patients, the price of these generic drug prices can be unpredictable. Some years they drop sharply; other times, a single medication might suddenly cost 500% more. Why does this happen? Let's break it down year by year.

How Competition Drives Prices Down

FDA the U.S. Food and Drug Administration Commissioner Scott Gottlieb documented in 2018 that generic drug prices typically fall by 90% within one year after initial generic entry when multiple competitors enter the market. This happens because competition forces manufacturers to lower prices to win market share. For instance, when three companies start making a generic drug, prices drop to about 52% of the brand-name version. With four or more competitors, prices fall to just 15% of the original brand price. This competitive dynamic explains why cardiovascular generics average 12% of brand prices while central nervous system generics average 25%. The FDA's competitive impact analysis shows that markets with one generic competitor typically see prices at 90% of the brand-name price, two competitors reduce prices to 65%, three competitors to 52%, and four or more drive prices down to 15%.

The Volatility Paradox

Despite the overall trend toward lower prices, some generic drugs experience extreme volatility. Between January 2022 and January 2023, approximately 40 generic drugs saw price increases averaging 39% (median 10%), according to IQVIA Institute data. More dramatically, a 2021 analysis of Medicaid data revealed that 8.2% of generic prescriptions experienced price surges between 100% and 500% during the 2013-2014 period. Take nitrofurantoin macrocrystals: its price jumped 1,272% between 2013-2018. Meanwhile, levothyroxine prices decreased 87% over the same period. This stark contrast shows how market-specific factors-like manufacturer exits or supply chain issues-can cause wildly different outcomes for similar drugs.

Market Concentration's Role

Market concentration is a major driver of price volatility. The top 10 generic manufacturers controlled 70% of the market by 2018, down from 150 active manufacturers in 2013. This consolidation means fewer players can manipulate prices. Dr. Aaron Kesselheim, Professor of Medicine at Harvard Medical School, found that 78% of generic drug price increases exceeding 100% occurred in markets with three or fewer manufacturers. Today, the top five companies control 52% of the market by sales, up from 38% in 2015. When only one or two companies make a drug, even small disruptions can trigger massive price hikes. For example, a single manufacturer exit can cause prices to spike over 1,000%, as documented by FDA Commissioner Robert Califf in 2023.

Regulatory Impacts

Regulations shape generic drug pricing in unexpected ways. The FDA's Generic Drug User Fee Amendments (GDUFA) implemented in 2012 reduced approval times from 30 months to 10 months by 2017, increasing competition. However, batch approvals sometimes create temporary price depressions followed by spikes. The Inflation Reduction Act introduced new rebates for brand-name drugs, but generics face less direct regulation. Instead, market forces dominate. A January 2024 Medicaid rule change removing the AMP cap on rebates influenced pricing behavior-though generic responses were more muted than brand drugs. The FDA's 2024 Strategic Plan includes initiatives to accelerate approvals for drugs with limited competition, targeting 20% faster reviews for products with fewer than three manufacturers.

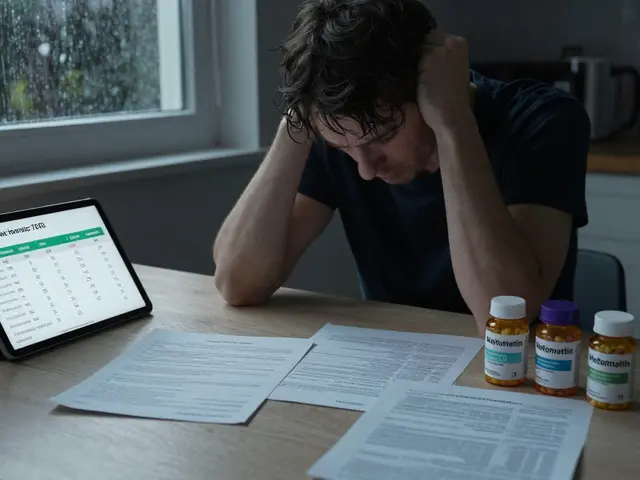

Real-World Patient Impact

For patients, these price swings have real consequences. On Reddit's healthcare forum, a user reported their generic lisinopril prescription increasing from $4 to $45 at Walmart over 18 months-a 247% jump confirmed by GoodRx data. Medicare beneficiaries surveyed by KFF in January 2024 showed 37% of seniors taking generics reported cost-related nonadherence, with 28% skipping doses due to price increases. Independent pharmacies face similar challenges: 42% experienced margin compression on 15% of generic drugs, with some flipping from profitable to loss leaders within weeks. The National Community Pharmacists Association documented that 68% of independent pharmacies had to absorb price increases for 20% of their generic inventory, with average margin reductions of $3.75 per prescription.

Current Trends and Future Outlook

Current trends point to continued volatility but with regulatory efforts to stabilize markets. The Congressional Budget Office projects generic drug prices will grow at 1.5% annually through 2030, below the 2.5% projected for brand-name drugs. However, ASPE's May 2024 analysis warns that 15% of generic drugs face 'high vulnerability' to price spikes due to manufacturing concentration, especially cardiovascular and CNS generics. Industry experts like Dr. Steve Miller predict increased FDA focus on competitive generic therapies will reduce high-volatility products by 25% over five years, though supply chain fragility remains a concern. The FTC's 2023 Generic Drug Competition Study found 65% of price increases exceeding 100% occurred in markets with three or fewer manufacturers, prompting new antitrust scrutiny.

Why do generic drug prices fluctuate so much?

Generic drug prices fluctuate due to market competition, manufacturing issues, and regulatory changes. When multiple manufacturers enter the market, prices drop sharply-up to 90% within a year. However, if only one or two companies make a drug, even small disruptions can cause massive price spikes. For example, nitrofurantoin macrocrystals saw a 1,272% price increase between 2013-2018 due to supply chain issues. The FDA notes that markets with three or fewer manufacturers account for 65% of extreme price hikes.

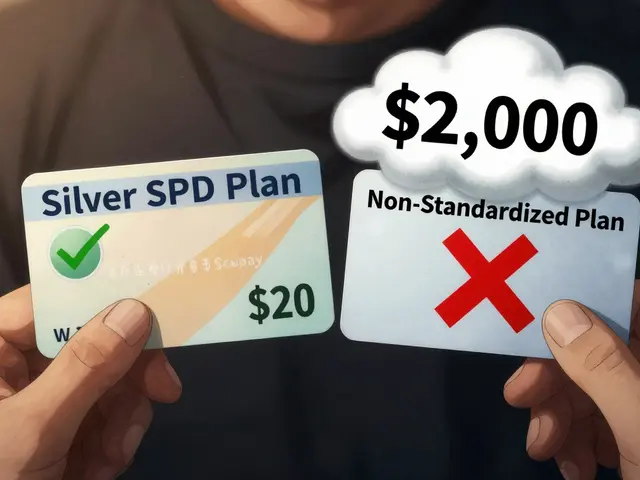

How does the number of competitors affect generic drug prices?

More competitors mean lower prices. With one generic manufacturer, prices stay near 90% of the brand-name version. Two competitors reduce prices to 65%, three to 52%, and four or more drive prices down to just 15%. This is why cardiovascular generics average 12% of brand prices while drugs with limited competition can spike to 200% of the brand price. The FDA's competitive impact analysis shows this pattern clearly across therapeutic classes.

What role does the FDA play in generic drug pricing?

The FDA sets approval timelines and monitors market competition. Faster approvals through GDUFA increased competition, lowering prices. However, the FDA also tracks supply chain issues and manufacturer exits that cause price spikes. In 2023, FDA Commissioner Robert Califf stated that 'the generic drug market functions well when there are multiple competitors, but becomes fragile with three or fewer manufacturers.' The agency's 2024 Strategic Plan targets faster reviews for drugs with limited competition to prevent price volatility.

How do regulations like the Inflation Reduction Act impact generic drugs?

The Inflation Reduction Act primarily affects brand-name drugs through Medicare rebates, but its indirect effects on generics are significant. For example, the January 2024 Medicaid rule change removing the AMP cap on rebates caused 20+ brand drugs to lower prices, which indirectly pressured generic manufacturers to adjust pricing strategies. However, generics face more market-driven volatility than regulatory pressure. The Act's focus on brand drug pricing has reduced competition in some cases, leading to occasional price increases for generics with few competitors.

What can patients do to manage rising generic drug costs?

Patients should compare prices using tools like GoodRx, which often shows prices 50% lower than pharmacy cash prices. Ask pharmacists about alternative generic versions or therapeutic equivalents. For chronic conditions, consider mail-order pharmacies or manufacturer assistance programs. If costs become unaffordable, discuss options with your doctor-sometimes switching to a different generic or brand drug can save money. Always verify prices before filling prescriptions, as costs can vary wildly between pharmacies.

9 Comments

I've been on generic meds for years, and the price swings are insane. One month my thyroid med was $5, next it's $40. It's not just me-my sister had to stop taking hers because of costs. The FDA says competition drives prices down, but when there's only one manufacturer left, that's when things get bad. Like nitrofurantoin, which jumped 1200%-that's because there were only a couple companies making it. I read that 65% of extreme price hikes happen in markets with three or fewer manufacturers. It's crazy how fragile the system is. Even small supply chain issues can cause massive spikes. I've seen pharmacies struggling to keep certain generics in stock. And when they do, the price is through the roof. It's not just about the cost to patients; it's about access. People skip doses, which leads to worse health outcomes. The government should do more to ensure multiple manufacturers for critical drugs. Maybe incentivize new companies to enter the market. But honestly, I don't know the solution. It's frustrating to see how much we rely on these drugs and how unstable the pricing is.

Pharma companies are just ripping us off-this system is broken.

Data shows that when there are four or more generic manufacturers, prices drop to 15% of brand. But when only one exists, prices can spike 1000%. The FDA's own data confirms this. Market concentration is the real issue here. Not regulation, but the lack of competition. For example, the drug in question here has only two makers now. That's why prices jump. It's not complicated. More competition = lower prices. Simple.

yeah totally makes sense more companies = lower prices but sometimes its hard to get new companies to enter market maybe if govt helped with funding or something but hey its good to know data we can fix this if we work together keep it real thanks for sharing

India has better generic drug pricing because we don't have this greedy pharma system. US is too capitalist. We should learn from India. Our government regulates prices properly. In US, it's all about profits. We have affordable generics because we don't let companies exploit people. You Americans need to wake up. This is why our system is better.

i've talked to so many people who struggle with these price hikes. it's not just numbers, it's real people's health. when you can't afford your meds, you skip doses or go without. that's dangerous. the system should be better. we need more transparency and competition. maybe even government intervention to keep prices down. it's about people's lives, not profits.

Hey Jesse, I totally get where you're coming from, but you're missing the bigger picture. 😊 The problem isn't just 'profits'-it's the entire structure of the US healthcare system. 🤔 We need systemic change, not just tweaking generics. Like, why don't we look at how other countries do it? 🌍 Europe has price controls, Canada has bulk purchasing. The US is stuck in this 'free market' nonsense. 🤦♂️ It's not just about generics; it's about the whole system being broken. 🤯 We need to overhaul it. But hey, at least we're talking about it! 😄

Jesse, you're spot on. It's heartbreaking to see people choosing between meds and rent. But honestly, what do you expect from a system where 'free market' means 'let the rich get richer'? 😏 The UK handles this better-NHS negotiates prices, and generics are cheap. But then again, we don't have the same profit-driven madness. Maybe the US should take a page from our book. Just saying.

uk has socialized medicine which is terrible. we need free market to keep prices down. if the government controlled prices like uk, it would be worse. the us system works better. you just dont understand how markets work. its not about profits its about innovation. generics are cheap because of competition. you guys in uk are just jealous. lol