For many seniors in the UK and across the US, the cost of medications can feel like a second rent payment. If you’re on Medicare and living on a fixed income, paying for insulin, heart pills, or arthritis drugs can push you to the edge. But there’s a federal program designed exactly for this - the Extra Help Program - and it can cut your prescription drug costs by up to 83%. The best part? You might already qualify without even knowing it.

What Is the Extra Help Program?

The Extra Help Program, officially called the Part D Low-Income Subsidy (LIS), is a federal program run by the Social Security Administration (SSA) to help people with limited income and resources pay for Medicare Part D prescription drug coverage. Since January 1, 2024, the program was simplified by the Inflation Reduction Act. Now, there’s no more partial help - if you qualify, you get full benefits. That means no premiums, no deductibles, and rock-bottom copays for your meds.Who Qualifies for Extra Help?

To qualify in 2025, your income and resources must fall below specific limits. These numbers are adjusted yearly based on the Federal Poverty Level.- Income limits: $23,475 per year for individuals; $31,725 for married couples living together.

- Resource limits: $17,600 for individuals; $35,130 for married couples.

Income here means your adjusted gross income plus any tax-exempt interest - like from municipal bonds. But not all income counts. The first $20 of monthly income is ignored. The first $65 of earned income (like from a part-time job) plus half of what’s left over is also excluded. And if your child is serving in the military and sends you money, that doesn’t count either.

Resources include cash, savings, checking accounts, stocks, bonds, and real estate you don’t live in. But your primary home, one car, personal belongings, household items, and up to $1,500 set aside for burial expenses don’t count toward your resource limit. That’s important - many seniors think they’re disqualified because they own a home or have a car, but those are protected.

How Do You Get Extra Help?

There are three ways to get into the program: automatic enrollment, simplified application, or full application.Automatic enrollment happens if you already get:

- Medicaid

- Supplemental Security Income (SSI)

- Help from your state paying your Medicare Part B premium

- Enrollment in a Medicare Savings Program (MSP)

About 12.5 million people are enrolled this way - no paperwork needed. If you’re on Medicaid, you’re already getting Extra Help. Check your mail. You should’ve received a letter from Social Security confirming it.

If you’re not automatically enrolled, you can apply in three ways:

- Online at ssa.gov/extrahelp - fastest and easiest

- By phone at 1-800-772-1213 (TTY: 1-800-325-0778), Monday to Friday, 8 a.m. to 5:30 p.m.

- In person at your local Social Security office

You’ll need to provide proof of income - like your last tax return or recent pay stubs - and documentation of your resources, like bank statements. If you don’t have tax documents, Social Security can often get them for you.

What Benefits Do You Get?

Once approved, your prescription drug costs drop dramatically:- No Part D premiums - you won’t pay anything for plans with $0 monthly premiums, which are available in every state.

- No deductible - the standard $595 deductible is fully covered.

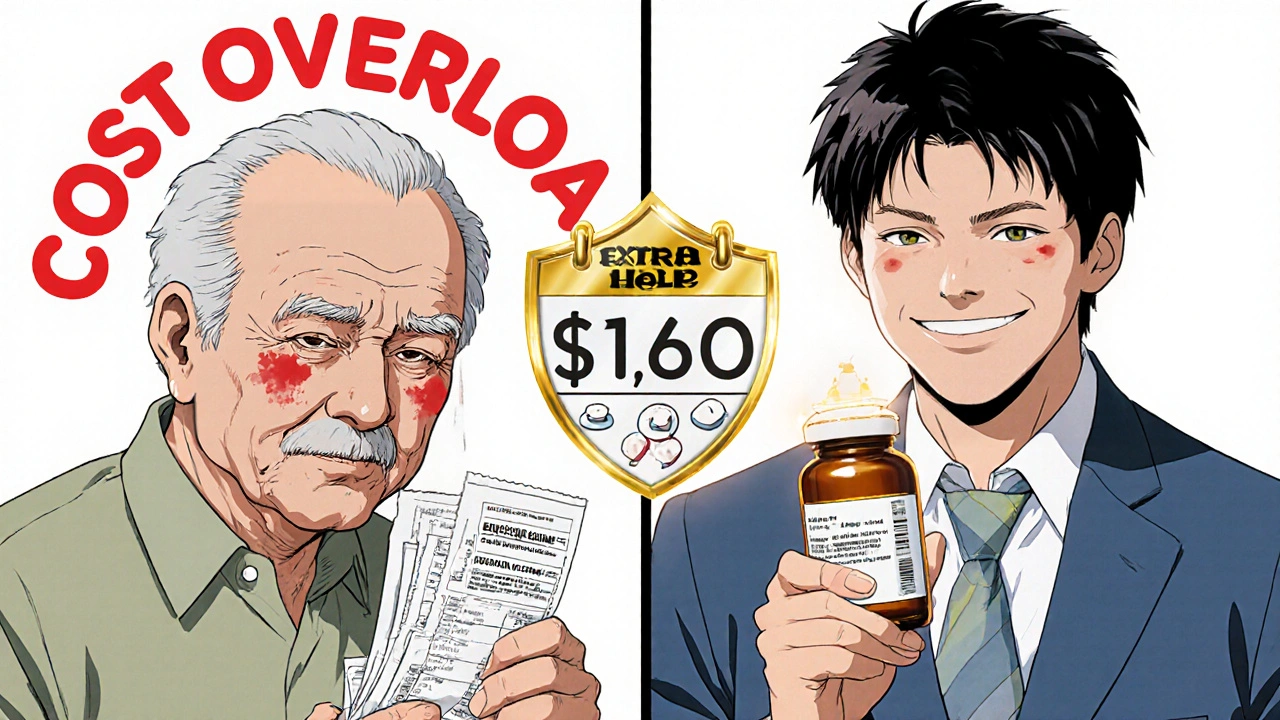

- Low copays: If your income is at or below 100% of the Federal Poverty Level, you pay $1.60 for generics and $4.80 for brand-name drugs. If you’re between 100% and 150%, you pay up to $4.90 for generics and $12.15 for brand-name drugs.

- No late enrollment penalty - even if you didn’t sign up for Part D when you first became eligible, you won’t be charged extra.

- Insulin capped at $35/month - since 2025, all Extra Help recipients pay no more than $35 for each insulin prescription.

- Free vaccines - flu, pneumonia, and shingles shots cost you $0.

These aren’t small savings. The average Extra Help beneficiary saves about $6,200 per year on prescriptions. For someone taking five or six medications, that’s hundreds of dollars a month.

Common Mistakes That Get Applications Rejected

Many people are denied not because they don’t qualify - but because they made a simple error. The most common mistakes:- Counting income that doesn’t count - like SSI payments or child support from a military child.

- Overvaluing assets - including the value of your primary home or car in your resource total.

- Missing documents - not submitting proof of income or bank statements.

- Waiting too long - applications take 3 to 6 weeks to process. Don’t wait until your next prescription is due.

According to SSA data, 22.1% of initial applications are rejected due to incomplete paperwork. If you’re denied, don’t give up. You can appeal. Many people get approved on the second try after correcting the mistake.

What If You’re Just Above the Income Limit?

You might still qualify. The income limits are strict, but the way income is calculated leaves room for flexibility. For example, if you’re a widow living alone and your only income is $24,000 from Social Security and $1,200 from a small pension, you might still qualify if you have high medical expenses that reduce your countable income. Social Security considers unreimbursed medical bills when calculating eligibility. Talk to a counselor - it’s worth asking.Also, if you’re in Alaska or Hawaii, the income and resource limits are higher. In 2025, Alaska’s income limit is $27,000 for individuals; Hawaii’s is $25,000.

Why So Many People Don’t Apply

The Government Accountability Office found that 4.3 million eligible seniors aren’t enrolled in Extra Help. That’s $26.8 billion in free assistance going unused every year. Why? Most don’t know they’re eligible. Others think it’s too complicated. Some believe they make too much money - even when they don’t.The Social Security Administration launched a new automated screening tool in February 2025 that checks your existing SSA records to see if you might qualify. If you’ve applied for SSI, Medicaid, or filed taxes in the past five years, it can flag you. You’ll get a letter in the mail if you’re a likely candidate. But don’t wait for it - apply yourself if you think you might qualify.

What Happens After You Apply?

If approved, you’ll get a letter from Social Security confirming your Extra Help status. If you’re not already enrolled in a Medicare Part D plan, you’ll be automatically enrolled in one with a $0 premium. If you’re already in a plan, your costs will drop immediately. The whole process - from application to lower copays - takes about 45 days.You don’t need to reapply every year. Once you’re in, you stay in unless your income or resources increase significantly. Social Security will check your eligibility automatically each year using your tax records.

Extra Help and Other Programs

Extra Help works with other assistance programs. If you get Medicaid, you’re automatically in. If you’re in a Medicare Savings Program (MSP), you likely qualify for full Extra Help. In fact, 92% of dual-eligible beneficiaries (those on both Medicare and Medicaid) are already enrolled.There’s also a short-term program called LINET, run by Humana, that gives temporary Part D coverage for up to two months if you qualify for Extra Help or Medicaid but don’t yet have a drug plan. It’s not a long-term solution, but it can bridge the gap while you wait for approval.

Looking Ahead

By 2027, the Centers for Medicare & Medicaid Services (CMS) expects over 16.9 million seniors to be enrolled in Extra Help. More plans are starting to offer enhanced $0 premium options just for LIS beneficiaries. Pharmacy benefit managers are also designing special formularies to keep costs low for this group.But funding is a concern. The Medicare Trustees Report warns the trust fund backing Extra Help could run out by 2041 if Congress doesn’t act. That’s decades away - but it shows why applying now matters. Your access to these savings isn’t guaranteed forever.

Do I have to be a U.S. citizen to qualify for Extra Help?

No, you don’t need to be a U.S. citizen, but you must be a legal resident. You must also be enrolled in Medicare Part A and Part B. Permanent residents with a green card who’ve lived in the U.S. for at least five years qualify.

Can I apply for Extra Help if I’m under 65?

Yes, if you’re under 65 and have Medicare due to a disability, you can qualify for Extra Help. The program is based on income and resources, not age. Many people with long-term disabilities on fixed incomes benefit from this program.

What if I’m married but my spouse doesn’t live with me?

If you’re legally married but don’t live with your spouse, Social Security only counts your own income and resources. You don’t have to include your spouse’s income unless you live together. This matters for seniors living apart due to health care needs or family situations.

Can I change my Part D plan after I get Extra Help?

Yes. Once you’re enrolled in Extra Help, you can switch your Part D plan once a year during the Annual Enrollment Period (October 15 to December 7). You can also switch at any time if your plan changes or if you move to a new area. Extra Help gives you more flexibility than most people realize.

Will Extra Help affect my other benefits like SNAP or housing assistance?

No. Extra Help is not counted as income for programs like SNAP (food stamps), Section 8 housing, or state cash assistance. Getting Extra Help won’t reduce your other benefits. In fact, applying for it can sometimes help you qualify for other aid because it shows your financial need.

Next Steps

If you’re a senior on a fixed income and take prescription drugs, don’t wait. Apply for Extra Help today. Even if you think your income is a little too high, you might still qualify. Use the SSA website or call 1-800-772-1213. Bring your Medicare card, proof of income, and bank statements. You have nothing to lose and thousands of dollars to save.Every year, millions of seniors miss out on this help because they assume it’s too complicated or they’re not eligible. But the truth is, the program was designed to be simple - and it works. You just have to ask.

9 Comments

Wow, this is actually one of those rare government programs that works the way it’s supposed to. I showed my grandma how to apply last month - she was scared it’d mess with her SNAP, but nope. Now her insulin costs $35 instead of $200. She cried. I cried. We both ate cheaper cereal after that.

Government handout. Just wait till the feds start rationing your meds next.

This is a classic socialist trap disguised as assistance. The SSA doesn’t care about you - they’re tracking your spending habits to build a behavioral profile for future policy control. You think they’re helping you? They’re just prepping you for mandatory drug rationing under the 2027 National Health Security Act. I’ve seen the internal memos. You’re being manipulated into dependency. Don’t fall for it.

And don’t believe that ‘automatic enrollment’ nonsense - if you’re on Medicaid, they’re already flagging your name for the National Health Registry. Your ‘savings’ are just a lure. The real cost? Your autonomy. They want you soft, compliant, and dependent. Wake up.

My cousin applied last year. Now she’s on a ‘special formulary’ and can’t get her thyroid med. They told her it’s ‘cost-effective.’ That’s code for ‘we decided what you’re allowed to take.’ This isn’t help. It’s control.

And don’t get me started on the ‘$35 insulin’ lie. That’s just a temporary cap before they raise it to $45 next year. They always do. The system is rigged. You’re not saving money - you’re being conditioned to accept less.

Why do you think they pushed this right after the Inflation Reduction Act? Coincidence? No. It’s distraction. While you’re filling out forms, they’re rewriting Medicare’s entire funding structure behind closed doors. You think you’re winning? You’re just the next line item in their budget spreadsheet.

Don’t apply. Don’t even click the link. If you’re eligible, they’ll find you - and when they do, you won’t have a choice. That’s not freedom. That’s surrender.

Let’s be real - the way this program is structured, it’s a quiet miracle. The exclusion of military child support from countable income? Brilliant. The burial fund exemption? Human. The fact that they don’t penalize you for having a car or a home? Revolutionary in a system that treats seniors like walking liabilities.

I worked at a senior center for six years. I saw people skip insulin because they were afraid of the ‘extra paperwork.’ One woman, 78, was taking half her pills because she thought the copay was $100 per dose. She didn’t know she could get it for $1.60. She cried when I told her. Not because she was poor - because she’d been ashamed for years.

The real tragedy isn’t the 4.3 million who don’t apply. It’s the ones who do - and get denied because they listed their cousin’s car as a resource. Or because they thought their $1,200 pension was too much. The system’s not broken. It’s just buried under bureaucracy. And most people don’t have the stamina to dig.

Apply anyway. Even if you think you’re over the limit. The SSA recalculates medical expenses. If you spent $8,000 on prescriptions last year, that’s $8,000 subtracted from your countable income. That’s not a loophole. That’s justice.

And if you’re in Alaska? You’re not ‘getting special treatment.’ You’re getting what every American deserves - access to life-saving meds without choosing between groceries and glucose.

Stop waiting for permission. You’re not asking for charity. You’re claiming a right you’ve paid into for 40 years.

THIS IS THE MOST IMPORTANT THING YOU’LL READ THIS YEAR. I’m not exaggerating. I’ve seen people die because they couldn’t afford their heart meds. I’ve held hands in ER waiting rooms while seniors whispered, ‘I’ll just wait till next week.’

Apply. TODAY. Not tomorrow. Not when you feel ‘ready.’ RIGHT NOW. Your life is worth more than your pride. More than your fear of bureaucracy. More than your belief that ‘someone else will handle it.’

Call 1-800-772-1213. Even if you think you’re too old, too sick, too broke - call. They have people who will walk you through it. One lady, 82, did it on speakerphone while her oxygen tank beeped beside her. Got approved in 11 days. Her copay dropped from $180 to $4.90.

This isn’t welfare. This is dignity. And it’s waiting for you. Don’t let fear steal it.

The program exists. The eligibility criteria are codified. The savings are quantifiable. The rejection rate is administrative not systemic. The real issue is not access but awareness. Awareness is a function of social capital. Those without it remain invisible to the system. The system does not fail. The people fail to navigate it.

My aunt got approved last week. She’s 84. She thought she made too much. She made $23,900. Turns out, her $800 in bond interest didn’t count. She’s saving $5,200 a year. She bought a new pair of shoes. Said she hadn’t bought new shoes since 2019.

Wait so this is like free medicine? But only if you're old? What about the young people with chronic illness? Why do they get nothing? This feels unfair. Also I think the government is lying about the numbers. They always are.

Valid point. The program is age-targeted, but disability eligibility is explicitly included - under 65, on Medicare due to disability? Fully eligible. The structure isn’t ageist - it’s need-based. The real gap is outreach. We need community navigators in clinics, pharmacies, churches. Not just SSA forms. Human touch matters.